Nanny tax withholding calculator

Your employee owes 765 percent of their cash wages in FICA taxes 62 percent for Social Security and 145 percent for Medicare. Unlike the federal nanny tax the Virginia household employers.

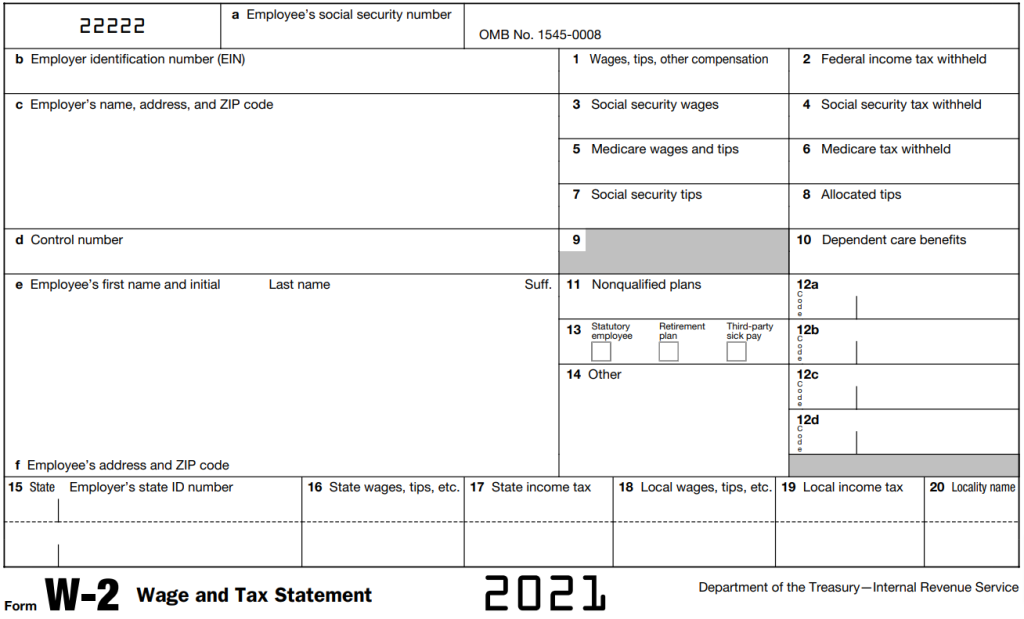

How To Read A Form W 2

This calculator is intended to provide general payroll estimates only.

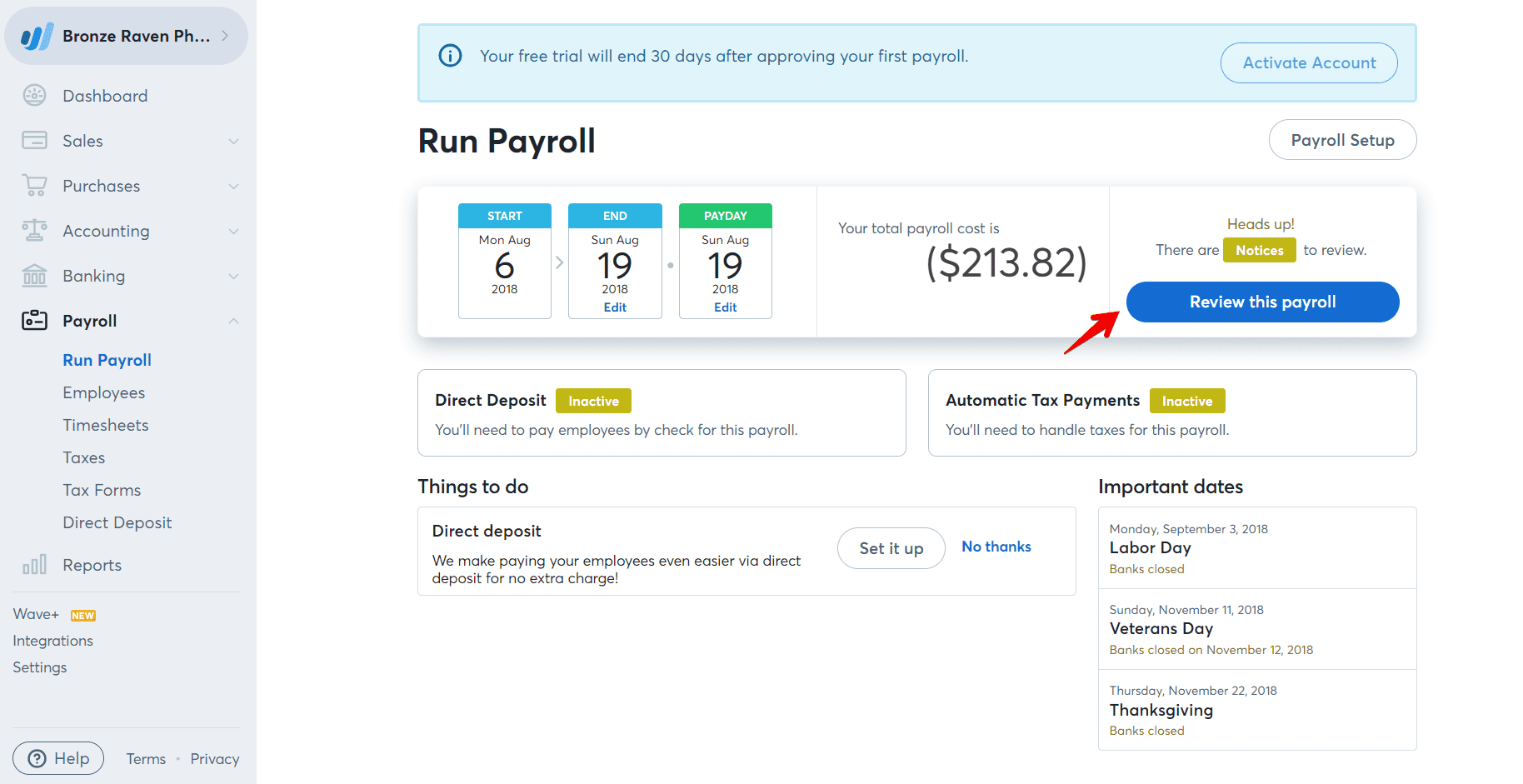

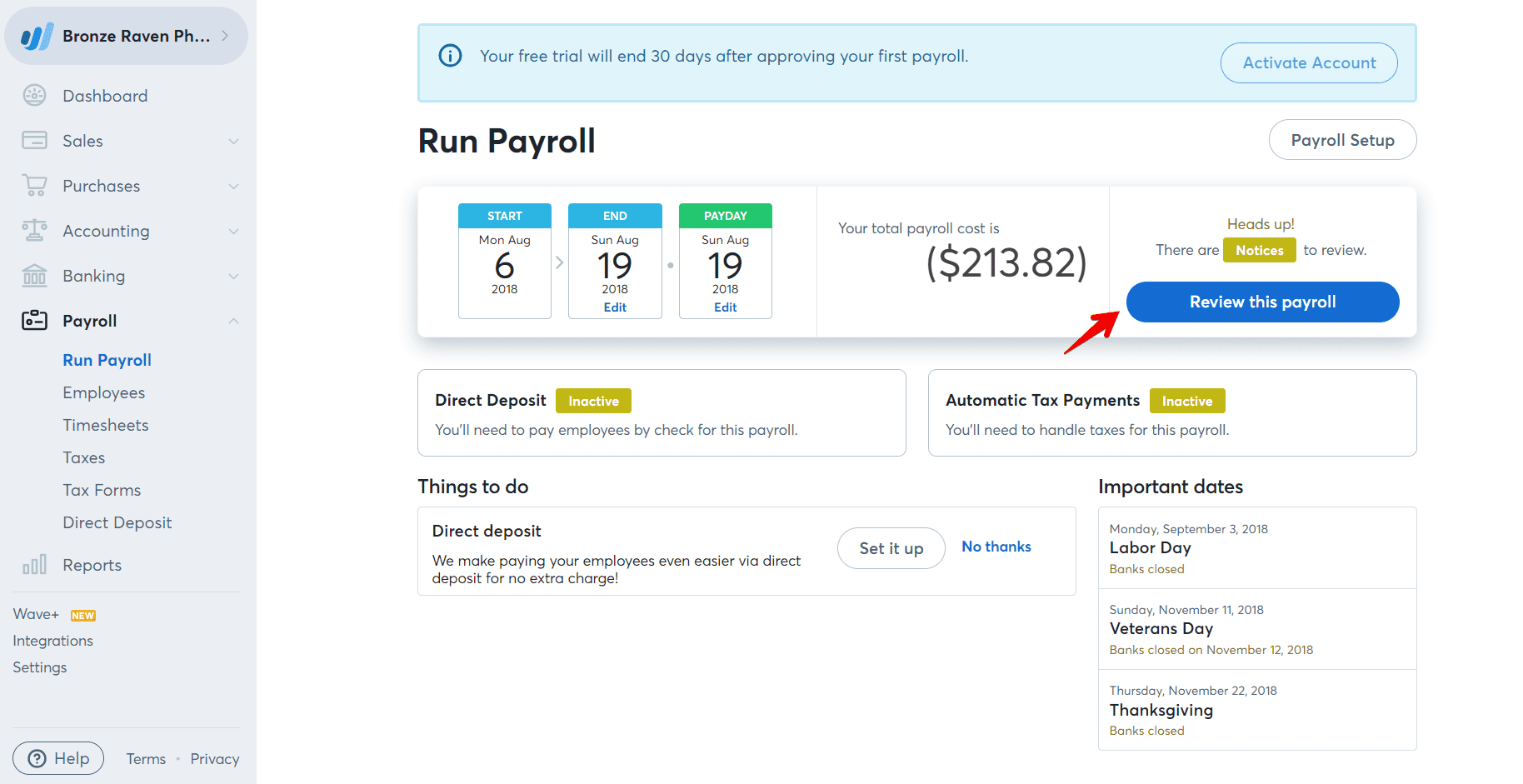

. Ad Easy To Run Payroll Get Set Up Running in Minutes. Ask your employer if they use an automated. Taxes Paid Filed - 100 Guarantee.

Were here to help. The annual filing provision is a filing option for qualified employers. You and your employee each pay 765 of gross wages 62 for Social Security and 145 for Medicare.

Our experts are available to answer your questions about paying household employees. How Your New Jersey Paycheck Works. However in most situations you need to pay 06 for unemployment insurance for the first 7000 you pay your nanny.

A household employer is responsible to remit 765 of their workers gross wages in FICA taxes. We work ONLY with and specialize in hand-holding household employers. IRS Withholding Calculator Can Help Figure Your Tax.

New York City. Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate. Were here to help.

Easy-to-use nanny tax calculator provides estimate of tax responsibility for a householder employer and tax withholdings for nanny or other domestic worker. Taxes Paid Filed - 100 Guarantee. Federal income taxes are also withheld from each of your paychecks.

The Nanny Tax Company has. Ad Easy To Run Payroll Get Set Up Running in Minutes. Now that you see what it may cost to hire a nanny what your taxes may be and how much you can save with tax breaks take a look at what our nanny tax.

Posted Tue Jul 19 2011 at 1257 am ET. Talk to a Specialist. To change your tax withholding amount.

Calculate pay and withholdings using The Nanny Tax Companys hourly nanny tax calculator or salary calculator. If you have too little federal tax withheld from. New York NY 10017.

Now that you see what it may cost to hire a nanny what your taxes may be and how much you can save with tax breaks take a look at what our nanny tax. This breaks down to 62 for Social Security and 145 for Medicare. Use The Nanny Tax Companys hourly nanny tax calculator to calculate nanny pay and withholding.

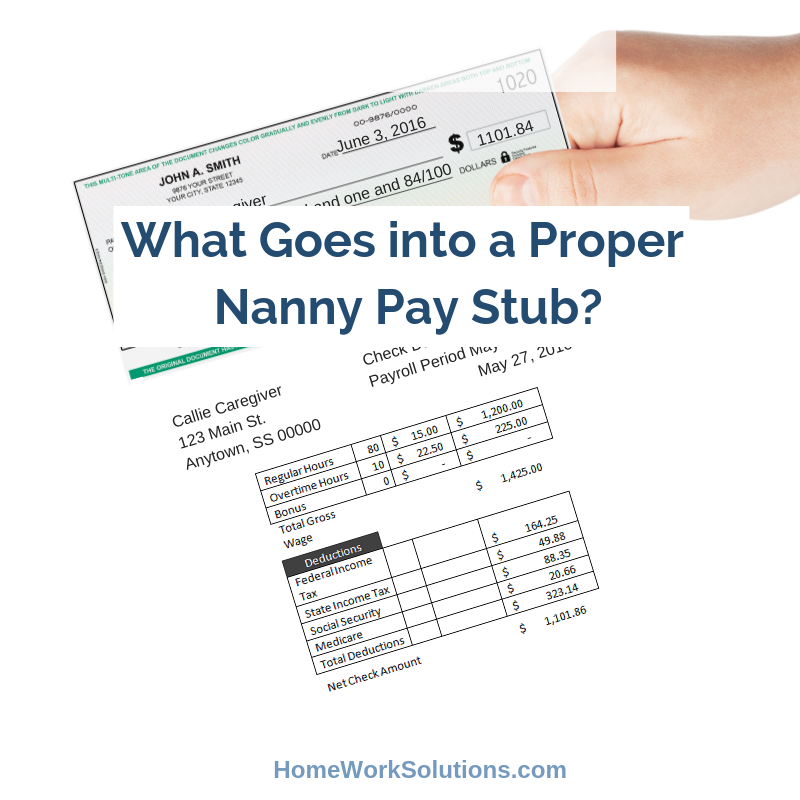

This calculator assumes that you pay the nanny for the full year. Then print the pay stub right from the calculator. For specific tax advice and guidance please call us toll free at 877-626-6924 and a NannyChex payroll and tax expert will.

It does not establish a new requirement for withholding. Calculate Employee Tax Withholding. Calculate social security and Medicare taxes.

Your employer uses the information that you provided on your W-4 form to. 871 a and 881 a impose a tax of 30 of the fixed and determinable annual or periodical FDAP income received from sources within the United. Please use one of our two nanny tax calculators to determine the correct.

Nanny Tax Payroll Calculator Gtm Payroll Services

/tax-day-2020-2000-8b5519bfa14a49d9abc778d0d099818d.jpg)

Tax Day How To Check If Your State Taxes Are Due

Tax Withholding Calculator For Employers Online Taxes Irs Taxes Federal Income Tax

The 10 Best Nanny Payroll Services 2022 The Baby Swag

What Goes Into A Proper Nanny Pay Stub

29 Free Payroll Templates Payroll Template Payroll Checks Payroll

Nanny Tax Payroll Calculator Gtm Payroll Services

Babysitting Tax In Canada

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Free Weekly Payroll Tax Worksheet Payroll Taxes Payroll Template Payroll Checks

2022 Pennsylvania Payroll Tax Rates Abacus Payroll

Prepare Free Nanny Payroll With Our Excel Template Nanny Self Help

What Are Employer Taxes And Employee Taxes Gusto

The Best Online Payroll Services For 2022 Pcmag

How To Manage Payroll Yourself For Your Small Business Gusto

Nanny Tax Payroll Calculator Gtm Payroll Services

Paying Taxes For Seasonal Employees