Mortgage calculator twice monthly payments

To help you see current market conditions and find a local lender current current Redmond motorcycle loan rates and personal loan rates personal loan rates are published below the calculator. Some of Our Software Innovation Awards.

Bi Weekly Mortgage Payment Calculator

Banks use an automatic bank draft for bi-weekly plans which means all mortgage payments will be on time.

. Making biweekly payments is a handy tool but be careful of scams or special programs that claim they can do this for you. According to the Mortgage Bankers Association the average size of new 30-year mortgages in the US. A good monthly home mortgage calculator tells individuals not only if they can afford a selected home but what kind of factors might.

Bi-weekly means you pay every two weeks for a total of 26 payments a year. Before taking a fortnightly option be sure to arrange it with your lender first. Mortgage loan basics Basic concepts and legal regulation.

This makes it easy to keep track of your payment due date. After the COVID-19 crisis the FOMC dropped the Fed Funds Rate to zero and issued forward guidance suggesting they would not lift rates through 2023. Since its founding in 2007 our website has been recognized by 10000s of other websites.

Redfins mortgage calculator estimates your monthly mortgage payment based on a number of factors. Put simply its a standard mortgage calculator with extra payments built-in so its really easy to use. The monthly vs biweekly mortgage calculator will find out how much faster you can pay off your mortgage with biweekly payments and how much you will save in interest payments.

This is not a credit decision or commitment to lend. But also very powerful. The second monthly payment budget calculator shows how expensive of a.

If you start making extra payments in the middle of your loan then enter the current loan balance when you started making extra payments and set the. A mortgage payment calculator takes into account factors including home price down payment loan term and loan interest rate in order to determine how much youll pay each month in total on your home loan. It usually comes in a line of credit paid to you by a lender.

For even more convenience many opt for automatic mortgage payments. Some companies offer to convert your monthly mortgage payment into biweekly payments for a one-time fee. By default this calculator is selected for monthly payments and a 30-year loan term.

Please see our bi-weekly mortgage calculator if you are using biweekly payments to make an effective 13th monthly payment. Fortnightly payments follow the 52-week calendar year instead of the 12-month timetable. 360 monthly payments for a 30 year loan.

Unless you like the idea of paying thousands of dollars more for your home than you have to and staying in debt twice as long as you need to opt for a 15-year mortgage if youre not. It can be a good option for those wanting to contribute more money toward a. However the homeowner can achieve the same effect on a monthly plan by utilizing electronic bill payment or an automatic bank draft.

This once-a-month option is common and its convenient as these payments are made on the same day each month. It has many options that you may need such as PMI property tax home insurance monthly HOA fees and additional mortgage payment. Mortgage rates and terms you may qualify for depend on your individual financial circumstances.

Semi-monthly means you pay twice a month for a total of 24 yearly payments. Paying a mortgage twice per month will improve the homeowners credit. Smart digital tools like the mortgage rate estimator allow prospective homeowners to explore a variety of pricing and rate options run different scenarios and really get a grasp on potential costs and payments.

Taking a reverse mortgage is a popular financial strategy that helps generate more income during retirement. Is approaching 400000 and interest rates are hovering around 3. See which type of mortgage is right for you and how much house you can afford.

The multiple extra payments can be for 2 or any number up until the loan is paid-in-full. To calculate how long it will take for the mortgage holder to pay off the average mortgage set up the calculator this way. Sometimes called real estate taxes property taxes are typically billed twice annually.

As mentioned elsewhere the calculator allows for a one-time extra payment or for multiple extra payments. Use this mortgage calculator to estimate how much house you can afford. In addition to making extra payments another great way to save money is to lock-in historically low interest rates.

While people might find it confusing this is not at all a second mortgage which requires monthly payments. 2020 has been a record year for mortgage originations as many homeowners refinanced to take advance of low. With biweekly mortgage payments you make 26 half-payments a year which equates to 13 total payments in a year.

Instead a reverse mortgage is the opposite of a traditional mortgage. One option to consider is a biweekly every two week payment plan. When you have a mortgage at some point you may decide to try and pay it off early.

Use our free mortgage calculator to estimate your monthly mortgage payments. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. Use our free mortgage calculator to easily estimate your monthly payment.

According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. A mortgage calculator helps prospective home loan borrowers figure out what their monthly mortgage payment will be. Your mortgage payment includes your principal and interest down payment loan term homeowners insurance property taxes and HOA feesThis gives you the ability to compare a number of different home loan scenarios and how it will impact your budget.

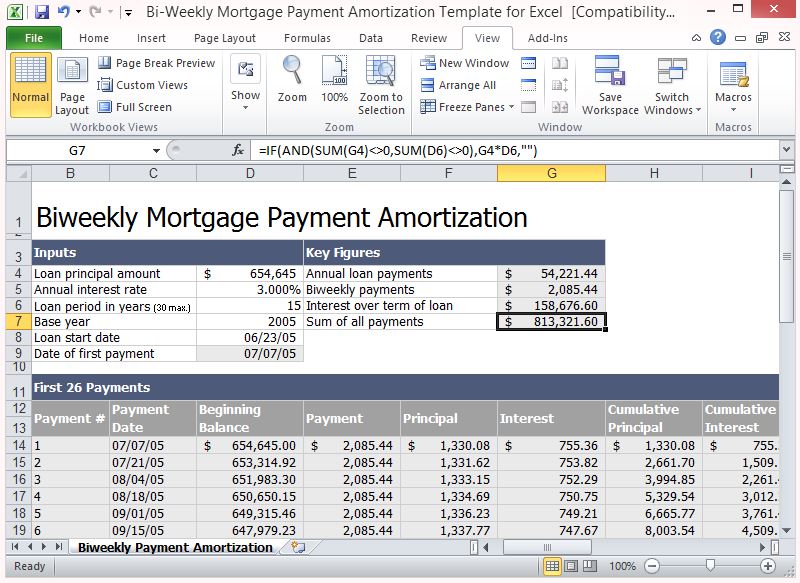

A person could use the same spreadsheet to calculate weekly biweekly or monthly payments on a shorter duration personal or auto loan. All monthly payment amounts above assume on time monthly payments each month for the full duration of the loan term eg. Because you make payments every 2 weeks this results in 26 half payments which is equivalent to 13 monthly mortgage payments.

Added 366 - days-per-year optionThis setting impacts interest calculations when you set compounding frequency to a day based frequency daily exactsimple or continuous or when there are odd days caused by an initial irregular length period. This isnt really true. Mortgage Amount or current balance.

Extra Payments In The Middle of The Loan Term. The 366 days in year option applies to leap. It shouldnt cost you anything to make extra payments on your loan.

All inputs and options are explained below. This calculator figures monthly motorcycle loan payments. An example would be if you had 100000 in savings and used all of it to finance a 500000 property with a 2500 monthly mortgage payment when your net income is 3000 per month.

You can therefore schedule extra payments between the regular due dates if doing so is better for your cash flow. When most people buy homes using mortgage loans they make monthly payments. Notice there is a big difference.

A 30-year fixed-rate. For example if youre interested in paying off your mortgage off in 15 years as opposed to 30 you generally need a monthly payment that is 15X your typical mortgage payment. Account for interest rates and break down payments in an easy to use amortization schedule.

Downloadable Free Mortgage Calculator Tool

Biweekly Mortgage Calculator

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Extra Payment Mortgage Calculator For Excel

Downloadable Free Mortgage Calculator Tool

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Bi Weekly Mortgage Payment Amortization Template For Excel

Mortgage Calculator With Extra Payments Clearance 53 Off Www Wtashows Com

Bi Weekly Mortgage Calculator How Much Will You Save Mls Mortgage Mortgage Amortization Calculator Pay Off Mortgage Early Mortgage Payment Calculator

Biweekly Mortgage Calculator How Much Will You Save

Biweekly Mortgage Calculator How Much Will You Save

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Biweekly Mortgage Calculator How Much Will You Save

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Mortgage Calculator With Extra Payments And Lump Sum Excel Template